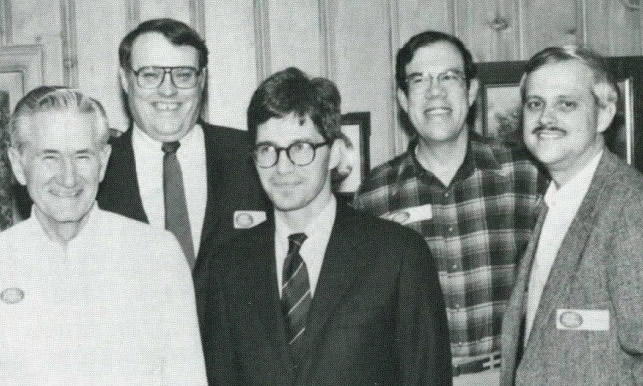

Larry Pettit (second from left) and Bob Kemp (right) with McIntire Finance faculty George McKinney (left), George Overstreet (center), and Rich DeMong (second from right)

The experiences of some university courses stay with students for their entire lives. They take the lessons to heart, seek the advice of their professors after classes, exchange ideas with their classmates well into the late hours, and delve so deeply into the coursework that they emerge fundamentally changed. For many McIntire graduates, particularly those who began their careers during the last quarter of the previous century, that course was known as the “GDP course” (COMM 478).

For nearly 100 years, the Commerce School’s innovative programs have expertly prepared graduates to make an immediate positive impact in the business world. Over the last two decades, the success of McIntire’s third-year Integrated Core Experience has received much warranted recognition for its ability to develop the skills and functional expertise of the undergraduate students who immerse themselves in its coursework.

Launched in the mid-1970s and taught for 30 years by Professor Larry Pettit, the GDP course served as a challenging precursor to McIntire’s hallmark undergraduate program. It was an effective trial for students’ future professional achievement. Widely recognized by faculty and alumni as the first such class to offer the unique opportunity to analyze industries and create real-world business solutions, GDP (originally known as “GNP”) became a defining course for generations of Finance students.

Later refined by the input and leadership of Professor Bob Kemp, GDP served as a platform for showcasing the intellectual, technical, and communication skills of students through team presentations. This created the foundation for a recruitment pipeline to hire McIntire students—a professional conduit that still exists for students today through Commerce Career Services.

“The course itself was designed to broaden the Finance students’ view of the total finance perspective,” says Pettit, who retired from teaching in 2007. “That is to say, finance is an integrative science, and you have to see all those little calculations we make actually go together to create and complement corporate strategies in a marriage between finance issues and corporate strategy. The course evolved; we had industry specialists asking our students questions about their assumptions and where they were going with their analysis. It was a trial by fire for these people. It gave them an opportunity to share with recruiters what they had learned, how good they were on their feet, and how well they understood the financial process.”

In addition to contending that he never would have come to teach at McIntire without Pettit’s advice, Kemp credits his former colleague and mentor with the ingenuity for envisioning the practical structure of GDP: “Fundamentally, what Larry did was create a course that was embedded in pragmatic macroeconomics.” He details how students were tasked with forecasting eight consecutive quarters, picking an industry to analyze, and then calculating the effects and implications of their macroeconomic forecast on their chosen business sector. “The course culminated with student presentations in front of McIntire faculty and alumni. Completing the course was not an easy experience; however, students were all proud of their achievements. It really was a bridge from academics to the real world.”

From Pettit’s perspective, “the course was hard work with great results.”

Onset of Opportunity

Pettit first arrived on Grounds in 1968, splitting his time between teaching Finance and Statistics. “I came to the School thinking I’d be there a year, and I stayed almost 40,” he says. At that time, the McIntire School already had an excellent reputation for its Accounting program and for getting Accounting students started in careers with major firms. Pettit was compelled to provide the same opportunities for students who had plans that didn’t include sitting for the CPA exam.

“I realized that McIntire students were not going to Wall Street unless we could give them skills that would get them there. I couldn’t get them into corporate frameworks if they didn’t understand how a company was going to operate within the greater economy and the key focus for analysis. It’s one thing to know how to do the calculations; it’s another thing to know how the calculation changes as the company changes,” Pettit says. “But I also couldn’t help but notice that we weren’t getting recruiters from the prestigious Wall Street firms, most particularly for Finance students.”

“I realized that McIntire students were not going to Wall Street unless we could give them skills that would get them there. I couldn’t get them into corporate frameworks if they didn’t understand how a company was going to operate within the greater economy and the key focus for analysis. It’s one thing to know how to do the calculations; it’s another thing to know how the calculation changes as the company changes,” Pettit says. “But I also couldn’t help but notice that we weren’t getting recruiters from the prestigious Wall Street firms, most particularly for Finance students.”

Given the high caliber of the undergraduates, Pettit was resolved to get these soon-to-be young professionals in front of those who could secure them interviews and positions after they walked the Lawn. First, by strengthening the Finance curriculum with an integrative financial analysis course, and second, by drawing professionals to Grounds to watch the presentation component, he hoped to satisfy student demand for robust employment opportunities with Wall Street firms.

In those early years, Pettit was challenged to get executives or recruiters to the GDP student presentations. Most took place in front of amenable alumni contacts who held corporate positions in various sectors that he reached out to himself.

“In the beginning, I had no resources except the telephone and the willingness to ask people with certain industry experiences. I would invite them, and on their own ticket, they would come down and participate in the class,” Pettit recalls.

Word quickly spread that, while challenging, the course offered preparation that students became increasingly interested in acquiring. Its popularity was such that Pettit says they quickly ran out of space for interested Comm students, and by the time the course reached its fourth year, alumni were calling him, asking if they could judge the presentations.

“We had judges from the best firms on the Street, and we had people from manufacturing situations. Further, we got well beyond McIntire alumni asking to come,” he says. “Once word got around in the industry, it didn’t take long.”

When Pettit handed the course over to Kemp in 1980, GDP was already an institution. “If you weren’t an Accounting student, it was the defining course of a McIntire graduate. Because all of a sudden, those students said, ‘You know what? I need to be prepared to leave this place.’ And that course was at the heart of empowering those students,” says Kemp.

Time and Tech

250 pages. Under Pettit, each student group submitted a written report with their presentations of 250 pages.

“Every December, I would get the flu and/or pneumonia, because I would be pooped out from reading all those reports—as well as all the presentations—and it took many hours,” he says.

Kemp jokingly remarks that copy centers were making quite a profit from all of his students’ print jobs. He believes that one of his key contributions to the course was limiting the size of the submissions by roughly 150-200 pages.

“I let him decide how many pages was enough,” says Pettit. “After a while, reading that many pages got to be a little tough. So getting those report sizes down was good for students and faculty.”

Adding to the required tenacity of students (and the faculty grading them) was a pressing need for resourcefulness when it came to computing, given the state of data processing in a pre-internet world. Pettit remembers students initially searching Grounds to find available computers, often reaching out to the Engineering School for assistance.

Kemp says that by the first half of the 1980s, the situation wasn’t much different, with students still requiring a place to run regressions with their punch cards—but not before he implored those in charge of the hardware to let them.

“I remember going to the basement at Gilmer Hall and begging. I got chewed out: ‘Your students are taking up too much of our capacity.’ We agreed that students weren’t going to use their computers until after hours. What they could do today in about 10 minutes took us 10 hours to do back in those days.”

Beyond negotiating for his students’ data processing time, Kemp was responsible for further changes to the course, which included directing a pivot from students conducting a macro forecast and industry forecast to a company forecast.

Next came a location change for the presentations themselves.

“We moved the presentations out of Monroe Hall into the Board of Visitors room, with a typical board room. The students would all dress up in pinstripes and rehearse. And they’d just knock our socks off.”

But before it came to the fateful day, Kemp recalls a great deal of time on the part of both students and faculty devoted to preparation for their big day presenting.

“I can remember lines out of Monroe Hall. Students were waiting to see Mr. Pettit. You ended up becoming their kind of intellectual father figure. I don’t ever remember having office hours. I learned the culture of the place. No, you don’t walk away from students; students are #1. And GDP taught me that as a young faculty member.”

Moments of Truth

Over the course of a few days, the five-person student teams would present the results of their research to the corporate industry experts. The culminating moments discussing their findings, while stressful, were transformative for the participants and served as a type of rite of passage for Finance students.

In addition to the questioning and judging by executives and faculty, the students evaluated each other as well, providing critiques about the work of their peers. Knowing the eyes of so many parties would be scrutinizing the presentation heightened the competitive atmosphere.

A former student of Kemp’s, Peter Engel (McIntire ’88), Global Chair of Investment Banking at J.P. Morgan, says that the tense experience of presenting and fielding a series of questions with real-world experts is something that stays with him decades later.

“One of my enduring memories is presenting our final recommendations to a panel of professionals—who were also potential employers—and then having 15 minutes of Q&A on any topic they found interesting. If that wasn’t intimidating enough, the fact that we did this presentation in the Rotunda in the room used for BOV meetings took the stress level up a few notches,” Engel says.

Pettit and Kemp say that the presenters took extraordinary efforts to fully commit to making a professional impression, employing striking visuals including market-quality posters and mock-up products to have on display as they spoke.

“Students didn’t want to present early, because it took several days to get through all the student groups; they wanted to go later so they could see what the other students went through,” Kemp says, adding that groups still untested would regroup in advance of their allotted time slot, pulling all-nighters and retooling based on the work they had seen.

But for Engel, being slated to address the room before most of his classmates was a relief.

“Fortunately for my group, we had one of the first presentation slots, at 9 a.m., and a group member who had the champagne chilling in his Lawn room waiting for us at 9:45 a.m.,” he says.

The jubilant response that came with being finished was a common one. “Students would throw big parties after GDP to celebrate,” Kemp recalls, noting how fourth-year students would rejoice at their accomplishment, feeling as though they had endured a great test and proven themselves as businesspeople.

Engel is one of the alumni who has both gone on to career success and returned to take part in the ritual from the other side of the room, 10 years after completing his own presentation. “I had the privilege of being asked to judge these presentations, which was another learning opportunity for me, a great reason to stay connected to McIntire, and a chance to see firsthand how a curriculum evolves to stay relevant.”

He says that both Pettit and Kemp often justified GDP’s outsized workload by repeating what would become a kind of bad joke platitude: “It’s our job as McIntire professors to make sure that if you ever get seated on a plane next to the Treasury Secretary of the United States, you are prepared enough to hold an intelligent conversation and not embarrass yourself or the McIntire School.” Engel notes that as a student, that scenario sounded incredibly unlikely. Yet it proved prescient.

“In reality, I’ve been seated next to two Treasury Secretaries on different transcontinental flights over the course of my career. I thought about that quote and that responsibility both times, and to my knowledge, didn’t embarrass either myself or McIntire either time!”

Ready to Roll

Kemp insists that the essential power of the course went far beyond the theoretical, thanks to the “total package” Pettit created: an all-encompassing approach that impacted curriculum, classroom dynamics—and even social interaction among students—to focus on transitioning from conceptual mastery to real-world practice and nuanced interaction among team members. Having gone through GDP, he says, students were confident in their abilities and aware that they could distinguish themselves at any firm.

Kemp insists that the essential power of the course went far beyond the theoretical, thanks to the “total package” Pettit created: an all-encompassing approach that impacted curriculum, classroom dynamics—and even social interaction among students—to focus on transitioning from conceptual mastery to real-world practice and nuanced interaction among team members. Having gone through GDP, he says, students were confident in their abilities and aware that they could distinguish themselves at any firm.

“Intellectually, it made them integrate their whole education into creating value for the firm, but it also gave them a sense of pride,” Kemp says. “They walked out and said, ‘Hey, I’m ready.’ It was like a great prize fighter training. So just the sheer confidence? I loved it. As a baby faculty member, I had never seen anything like it. And I couldn’t get enough of it,” he says.

Pettit notes that by working closely in groups, students learned to manage people, overcome interpersonal problems that arose, and become absorbed in the kind of competitive environment facing employees of large companies everywhere.

The risk and uncertainty inherent in the projects that would ultimately provide self-assurance also gave rise to honing crucial teamwork and communication skills. The open-ended nature of the work provided what Kemp calls “the ultimate growing experience.”

He says that after presentations, one of the final questions the professor would put to the presenting students would also prove to be one of the most important: Would they be willing to buy the firm they chose and researched?

“We would ask, ‘Are you willing to risk your own personal money? Do you believe in your forecast enough to buy this firm?’ And eventually students evolved in their thinking to say, “No, I don’t want this firm.” They chose it, and they had committed to it. But some of them said, ‘I love this firm, and I’m buying it.’ The course was just not an academic exercise; it was very personal.”

The Legacy of GDP

As difficult as presenting was for students, teaching the course was a massive undertaking by faculty as well.

“Frankly, some of my colleagues would do it for one semester, and they would do about anything not to do it a second,” remarks Pettit.

His comment is met with Kemp’s laughter. “Because you didn’t do anything that semester except teach GDP,” he says, explaining that Pettit’s focus on students was always paramount and the culture of the Commerce School that spoke to him most deeply.

In its time being offered, the legacy of Pettit’s brainchild that would eventually be stewarded by Kemp and included many Finance faculty over the years.

Kemp believes that while GDP was originally created for Finance concentrators, the Commerce School embraced the philosophy of incorporating the wholly integrative nature of business that GDP first offered.

“Today’s curriculum, with its focus on communication, professionalism, working with human resources, management, leadership, and alumni engagement in the classroom—that started with GDP,” Kemp says. “You may not see the GDP course—but so much of the foundation of what you see started in GDP. It wasn’t that ‘they stopped the course’ and abandoned those goals. The School evolved, and rightfully so, in my opinion. Those goals moved across the entire curriculum.”

Pettit says that the course accomplished what he set out to do. “We created a channel for Finance students to know where to look for a job and how to get one. And the other thing—I’ve never been uncomfortable trying to solve a problem that nobody had put a fence around. I wanted my students to be able to look at a situation and take it apart piece by piece and put it into a framework for analysis. I think we accomplished that.”

“There is nothing more important than those incredibly bright, hardworking, ambitious, dreaming kids,” Kemp says. “We have that opportunity for two years to nurture that and give them a good foundation. What Larry did was instill the idea that if our students do great things, we’ve done great things; if they don’t do great things, we’ve failed them. And that is a foundation value at the Comm School. Larry was at the heart of it.”

Kemp pauses to think back on the years of presentations he judged. “I will tell you that with every one of those presentations, I grew,” he says. “Everyone in the room grew and learned from their fellow students. And the judges would say, ‘I never thought about that.’ It was a great intellectual experience.”

“It was. It was terrific,” Pettit says, revealing that, even now, he hears from his former students. “I still get telephone calls—and it usually starts off with ‘Remember me in GDP?’”