The tax audit process may have a bad reputation for being rife with inefficiencies, but changes in the federal government may be coming to address them. A recent article by business website Forbes discusses new IRS Commissioner Billy Long’s vision, as well as academic research on the subject by Commerce School Professor Jeri Seidman and her co-authors.

The Forbes piece, “A New IRS Commissioner and the Promise of More Efficient Tax Audits,” explores the reasons Long’s nomination was so thoroughly scrutinized, what his vision for the tax authority may look like in practice, and research findings on the current and future state of the tax audit process, referencing a forthcoming article by Seidman in Contemporary Accounting Research, “Tax Audits and the Policing of Corporate Taxes: Insights from Tax Executives.”

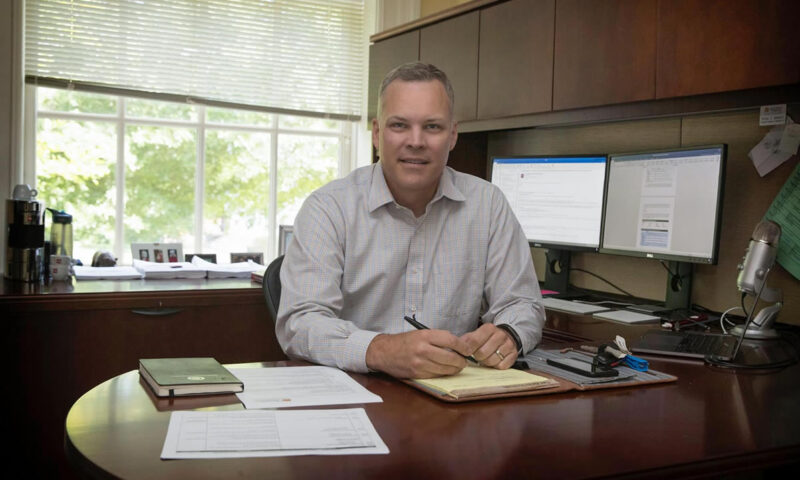

Detailing key discoveries in the article by Seidman and her Indiana University Kelley School of Business co-authors Roshan Sinha and Bridget Stomberg, Forbes relates the lack of effective practices in the current tax audit process while revealing surprising findings from the study.

In interviewing 26 tax executives who served as directors and VPs of tax at publicly traded U.S. companies, Seidman explains how those executives respond to auditing, noting that they share information about specific tax agents and audit strategies with their peers and competitors, are less likely to accept outcomes when they perceive audits as unfair, and levy negative comments at the IRS about their technology, especially in comparison to Europe and Australia.